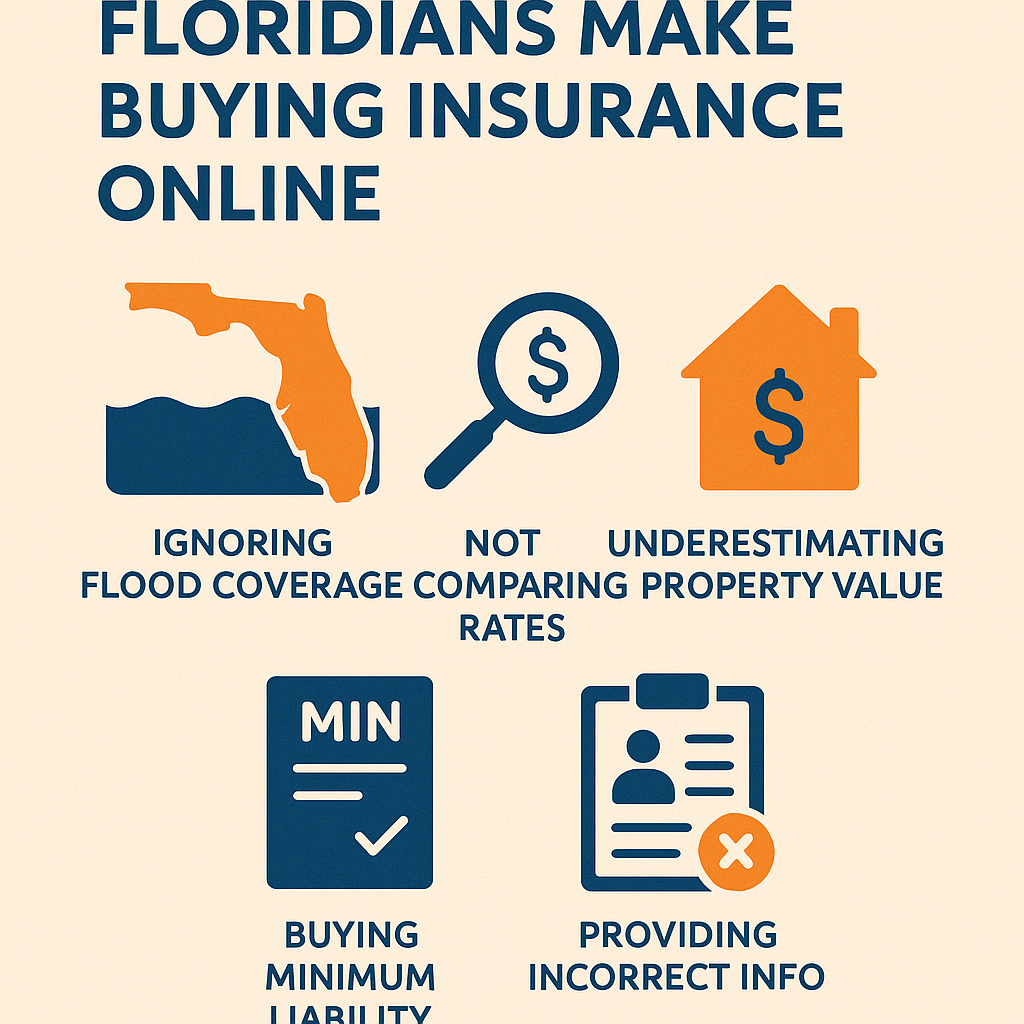

Searching for the right insurance coverage online can be tricky for Floridians. Many shoppers believe that buying insurance online will save both time and money. However, common mistakes can lead to costly errors or even leave you without the protection you truly need. Since Florida has unique insurance requirements, skipping crucial steps could cause more harm than good. Online tools make shopping easier, but they also increase the risk of missing important details. Understanding where people often go wrong can help you avoid those same pitfalls. With the right approach, you can make smarter choices and secure better coverage for yourself and your family. Let’s explore the five biggest mistakes Floridians make when shopping for insurance online.

Overlooking Local Insurance Regulations in Florida

Many Floridians do not realize how different local regulations are from those in other states. Each state sets its own rules about minimum coverage, required add-ons, and policy limits. When people shop online, they often rely on national insurance websites, which may not highlight Florida’s specific requirements. As a result, shoppers might buy policies that do not meet state laws. Failing to comply with these regulations could leave you underinsured or subject to fines. Staying informed about the latest rules is essential for every Florida resident.

Florida’s weather risks make local regulations especially important. Hurricanes, flooding, and sinkholes are real threats that can impact both property and auto insurance needs. Many online quote systems do not automatically suggest coverage for these local dangers. Therefore, it’s easy to miss required riders or endorsements. Overlooking these extras can lead to denied claims after a disaster strikes. Always double-check your policy against state recommendations.

Additionally, according to FloridaInsuranceQuotes.net, insurance agencies in Florida must follow strict licensing and consumer protection laws. Some online insurers may not be authorized to sell certain products in the state. Before buying, verify that your chosen company complies with all Florida rules and regulations. A little research now can save you a lot of frustration later. Always confirm that your policy complies with state mandates before clicking “Purchase.”

Ignoring Coverage Details When Comparing Policies

Many people focus on price alone when shopping for insurance online. Comparing monthly premiums feels like the quickest way to save money. Unfortunately, the cheapest policy may not offer the protection you need. Essential details such as deductibles, coverage limits, and exclusions are often overlooked. A lower price usually means less comprehensive coverage, which could be a costly mistake after an accident or disaster.

Some policies exclude common risks in Florida, such as flood or windstorm damage. If you ignore the fine print, you could find yourself unprotected when you need help most. Always take the time to read each section of your insurance quote. Look for coverage gaps that could leave you exposed to significant expenses. Comparing only the basics can lead to serious surprises later.

In addition, not all policies offer the same benefits or customer support. Some insurers cut costs by limiting claims assistance or repair options. When you compare policies, make sure to review all included services and coverage terms. Taking a few extra minutes to review the details can save you money and stress down the road. By prioritizing coverage quality over price alone, you ensure better protection for yourself and your loved ones.

Failing to Verify Insurer Credibility Online

Trusting unfamiliar or unverified insurance companies is a frequent online shopping mistake. Many websites promise quick quotes and low prices, but not all of them are legitimate. Fraudulent insurers can disappear with your money or leave you stranded during a claim. Always research the company’s license status with Florida’s Office of Insurance Regulation before making a purchase. Genuine insurers will have clear licensing information and positive customer reviews.

Reading online reviews can help you spot patterns of poor service or denied claims. However, not every review is trustworthy. Some companies pad their ratings with fake comments to boost their reputation. Try to find feedback from independent sources or consumer protection sites. Checking multiple review platforms can give you a more accurate picture of an insurer’s reliability.

Additionally, reputable insurance companies will offer transparent contact information and clear policy documents. If a website hides its phone number or physical address, consider it a red flag. Always reach out to customer service with questions before buying. Reliable companies will answer your questions promptly and thoroughly. Double-checking credibility reduces the risk of scams and helps you choose a trustworthy insurance provider.

Underestimating the Importance of Policy Reviews

Many Floridians buy insurance online and never look at their policies again. However, life changes quickly, and so do your needs. If you do not review your policy regularly, you could miss out on essential updates or better rates. Reviewing your policy each year ensures that your coverage keeps up with changes like new cars, renovated homes, or family additions. Even a small change can impact your insurance needs.

Policy terms and conditions may change without much notice, especially after a renewal period. Insurers sometimes update what they cover or adjust premiums based on risk. Ignoring these changes could leave you with less protection than you expect. Always read renewal documents and communicate with your insurer if you have questions. Staying proactive helps you avoid coverage gaps and unnecessary expenses.

Additionally, policy reviews give you a chance to take advantage of new discounts or offers. Insurance companies often develop new products or incentives for loyal customers. Reviewing your options regularly means you can optimize your coverage and possibly lower your costs. Taking the time to review your policy is an investment in your financial security and peace of mind.

Skipping Professional Advice Before Making Choices

Relying solely on online research can be risky when buying insurance. Many Floridians believe they can figure everything out on their own, but the insurance world is complex. Professional agents or brokers understand local regulations and can explain tricky policy language. Consulting an expert helps you find suitable coverage for your unique situation. Even a short conversation can reveal options you might have missed online.

Insurance professionals can identify exclusions or recommend additional coverage based on your needs. In Florida, risks like hurricanes and floods require specialized policies that may not be obvious in online quotes. A professional advisor will ensure you are fully protected against local threats. They can also clarify confusing terms and help you avoid common pitfalls.

Additionally, discussing your options with a licensed agent can save you money. Agents know about discounts and bundling opportunities that online forms might skip. They also advocate for you if you ever need to file a claim. Seeking professional advice is a smart way to protect your assets and avoid costly mistakes. Collaboration with a knowledgeable advisor leads to better decisions and more peace of mind.

Conclusion

Shopping for insurance online in Florida offers many conveniences, but it also comes with real risks if you are not careful. By overlooking state regulations or choosing the wrong coverage, you might end up with policies that fail to protect you during emergencies. Many Floridians also make the mistake of trusting unverified insurers or ignoring the importance of policy reviews. Rushing through the process without professional advice increases the chance of costly errors. Therefore, it is crucial to research carefully, verify every detail, and ask questions when in doubt. Seek out trusted professionals who know the local landscape and can guide you through important decisions. Regularly reviewing your policy ensures you always have the proper protection as your needs change. Florida’s unique risks and regulations deserve special attention during your search. With the right approach, you can make shopping for insurance online both safe and successful. Take your time, avoid common traps, and you will secure better coverage and greater peace of mind for you and your family.